CONDOMINIUM FINANCIAL & ACCOUNTING FEATURES

FULLY FEATURED ACCOUNTING SOFTWARE

UpperBee includes traditional accounting features such as journal entries, bank reconciliations, accounts payable and receivable, financial statements, complete with a balance sheet and statement of earnings and accompanying notes.

However, UpperBee really shines with features specifically designed for managing condominium corporations and homeowners associations to manage your finances, assess and collect common charges (HOA dues or condo fees), pay your bills, keep track of payable and receivable accounts, reconcile bank accounts, automatically invoice recurring charges, create custom allocation keys, compare budgeted results to actuals, and much more!

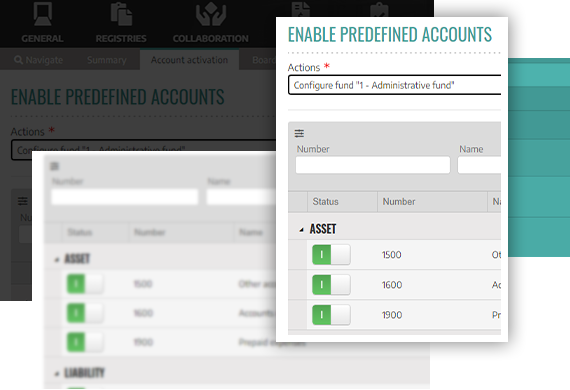

Customizable chart of accounts

You want more or less details, no problem, establish the chart of accounts that meets your needs. In addition, you can allocate to each of your accounts an IGRF code that allows you to quickly process your Canadian tax returns.

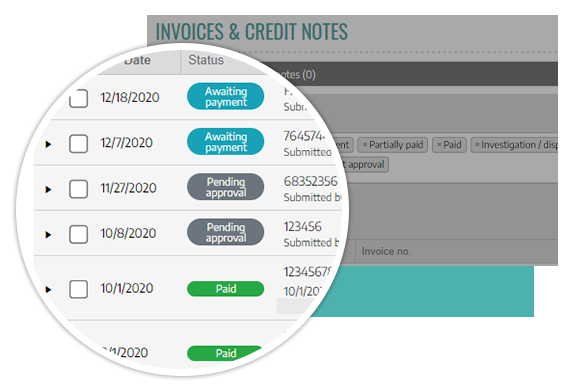

Invoices and credits

Go paperless - Keep all the invoices and credit notes of your condominium association or HOA in electronic format for future reference.

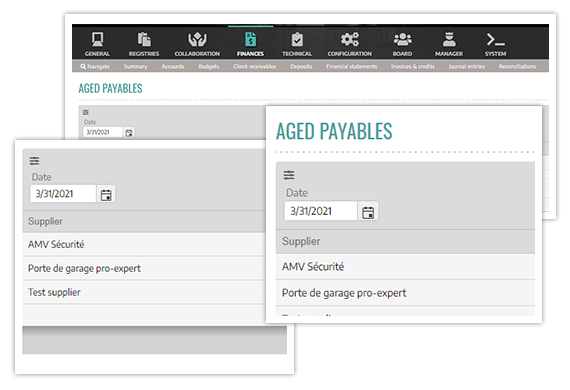

Payments

Access your payment history and quickly view all of your condominium association or HOA unpaid bills.

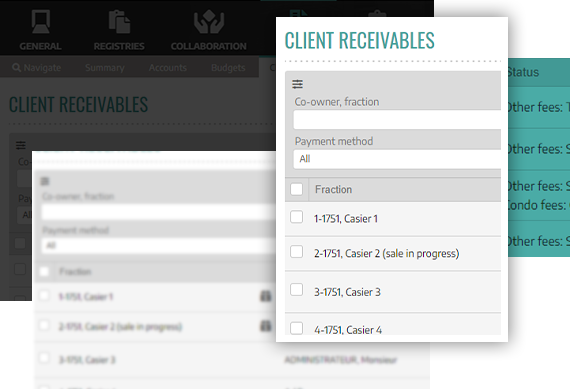

Incomes

Board members have access to the detailed statement of account of each owner. Each owner can also access their statement of account. UpperBee can accommodate multiple sources of income other than standard fees - Finally, keep track of all your condominium association or HOA revenues using simple and intuitive tools.

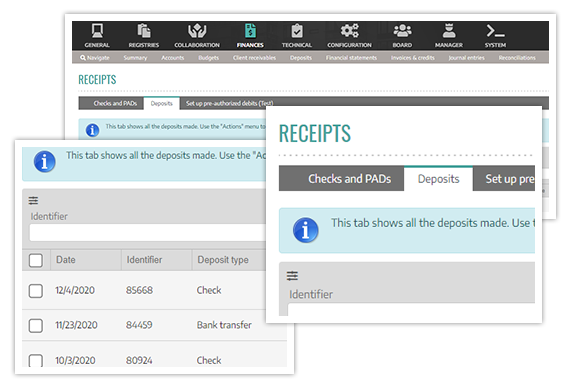

Cheques, pre-authorized debits and deposits

Collect co-owners’ common expenses and contributions to various funds payments ("condo fees") using UpperBee’s 3rd party integrated pre-authorized debit features, and let UpperBee make all the required accounting entries automatically for you.

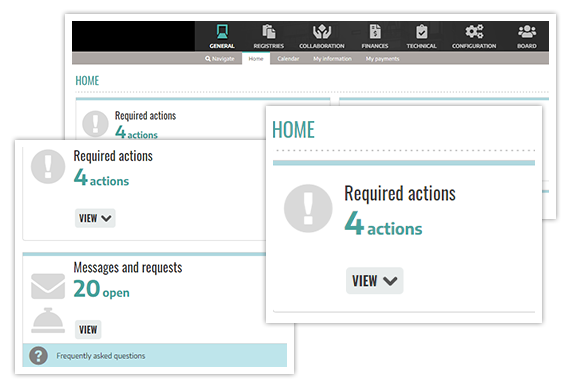

Financial information

Each owner has access to their financial information: Most recent statement of account, Payment history, and the budget and financial statements of the condominium association or HOA.

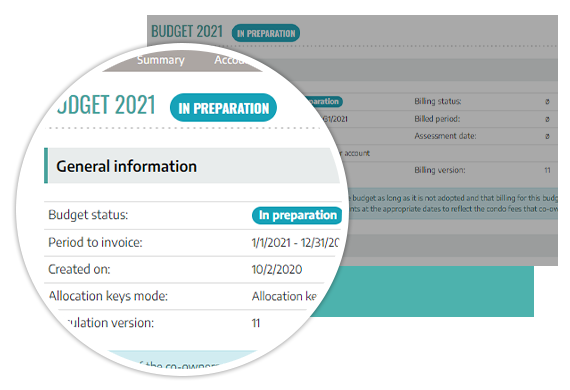

Budgets

Create your budget and invoice owners of your condominium association or HOA automatically at the specified frequency (e.g., monthly, quarterly, semi-annually or annually, etc.). Allocate your budgeted expenses automatically based on historical results, and bill association fees - it's that simple. UpperBee will automatically take into account fractions and distribution keys. No other operation is required to record your income, UpperBee does it for you. Create annual and special budgets that include common operating expenses, contingency fund contributions, and contributions to any number of personalized funds. Automatically allocate each owner’s share of said expenses and contributions.

Inventory

Speed up invoicing while tracking sales of keys, access fobs, and other miscellaneous items.

Penalties

Set up fees associated with the various penalties set out in your condominium association or HOA by-laws to reduce the workload associated with issuing penalties.

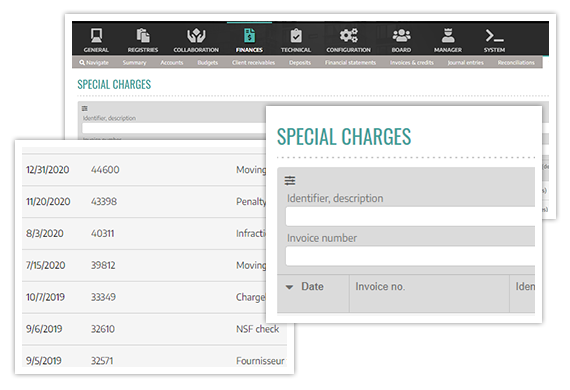

Special charges

Invoice special charges (fines, service fees, etc.) to one or more co-owners from a predefined list, reducing both your processing time and the risk of errors.

Recurring charges

UpperBee allows you to schedule charges outside the operating budget to be billed at regular intervals.

Journal entries

Journal entries allow you to enter any transaction for which UpperBee does not offer an automated feature, so you are never left empty-handed. In addition, accruals reversal can be set to be automatic.

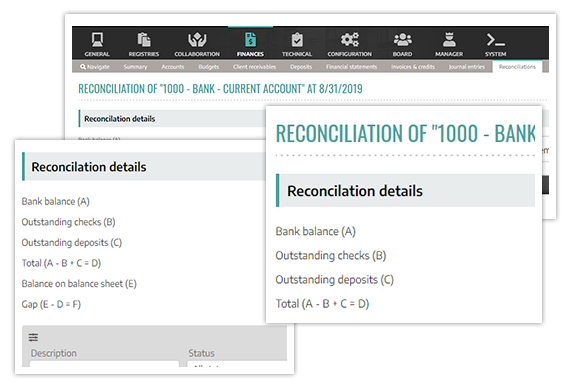

Bank reconciliations

Reconcile your accounts periodically to ensure the accuracy of your accounts.

|

Gain efficiency by switching to UpperBee Pay and simplify your bank reconciliations with automation! |

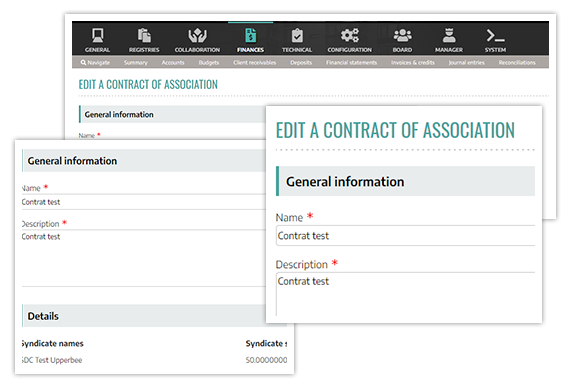

Contracts of association

This feature allows for the sharing of expenses with another entity, say for having access to an offsite gym or parking.

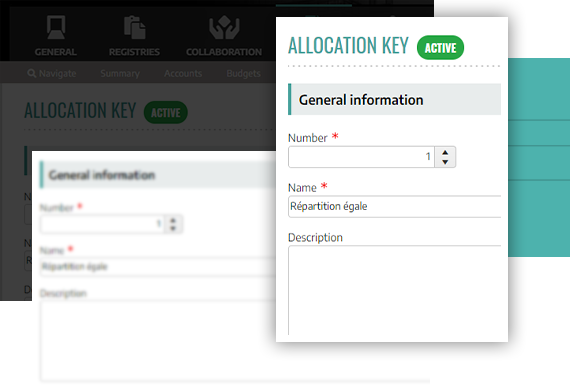

Allocation keys

Create allocation keys to fit your needs. The flexibility of UpperBee ensures that there are no situations where you cannot distribute automatically common expenses and contributions to the contingency fund.

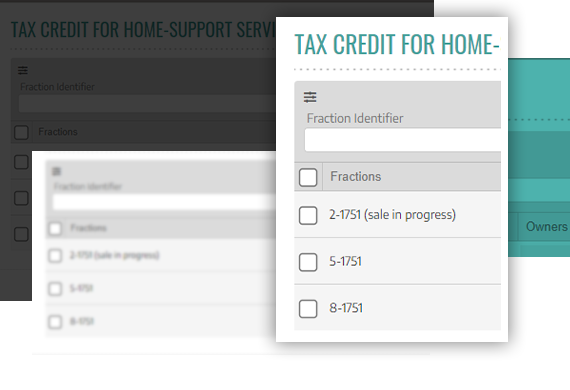

Home support tax credit

Automatically generate the forms for home-support tax credit for seniors (available to users of the province of Quebec, Canada).